Present Value

Present Value = Value today of a future cash flow.

Discounting = finding out the present value from the future value.

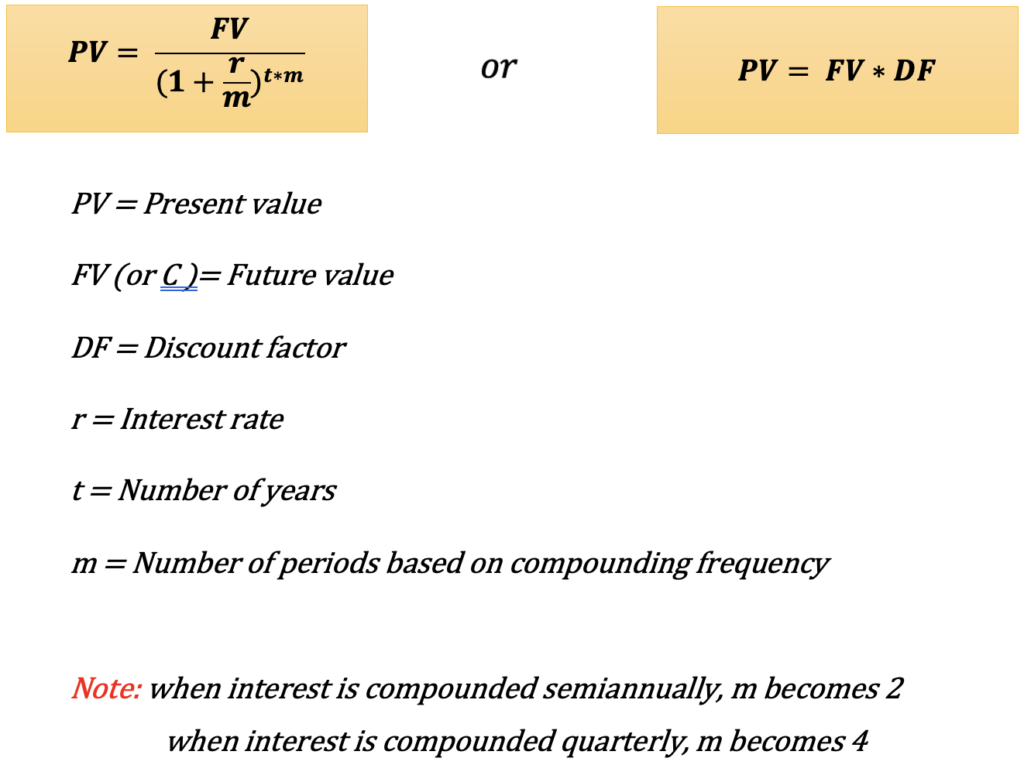

Formula:

DF measures the PV of $1 received in year t. (FYI there is an indirect relationship between the PV and the interest rate and the PV and time. Therefore, the higher the interest rate, the lower the PV, also the longer you have to wait for ur money, the lower its PV).

Future Value

Future Value = Amount to which an investment will grow after earning interest.

Compounding = process of finding out the future value from the present value.

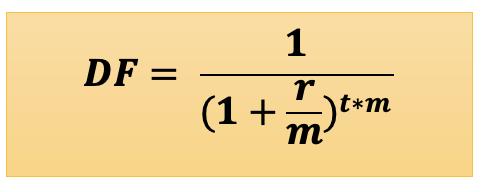

Formula:

(FYI there is a direct relationship between FV and the interest rate. Therefore, the higher the interest rate, the higher the FV and the faster your savings grow).

Present Value of a Perpetuity

Perpetuity = Constant cash flow paid at the end of every year forever.

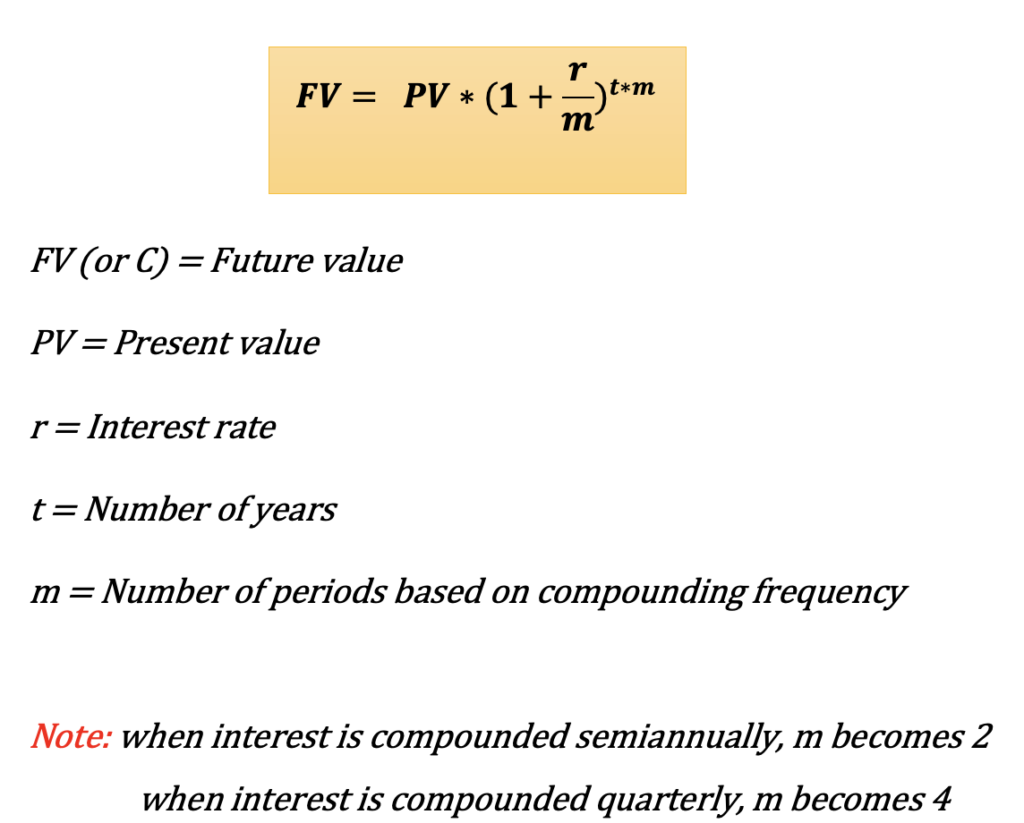

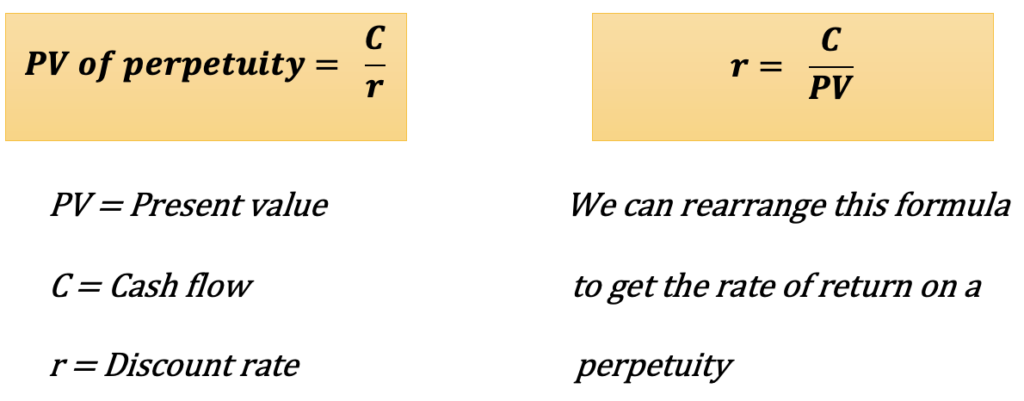

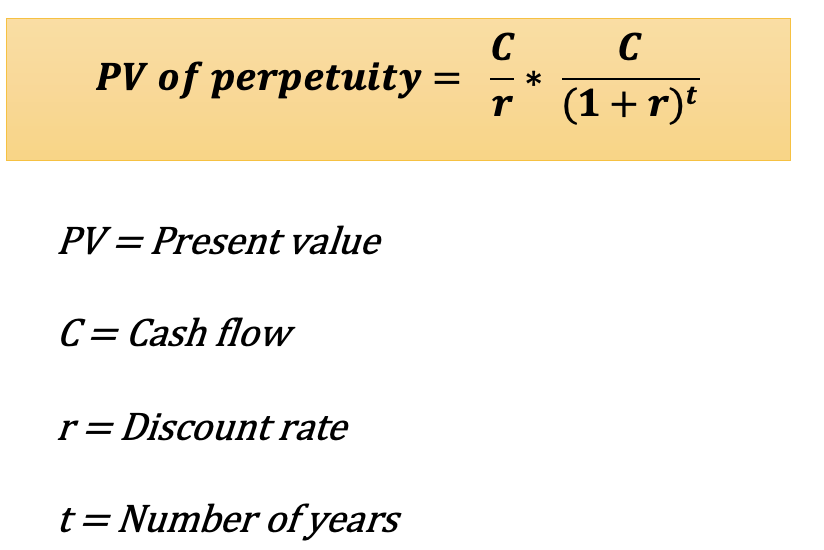

Formula:

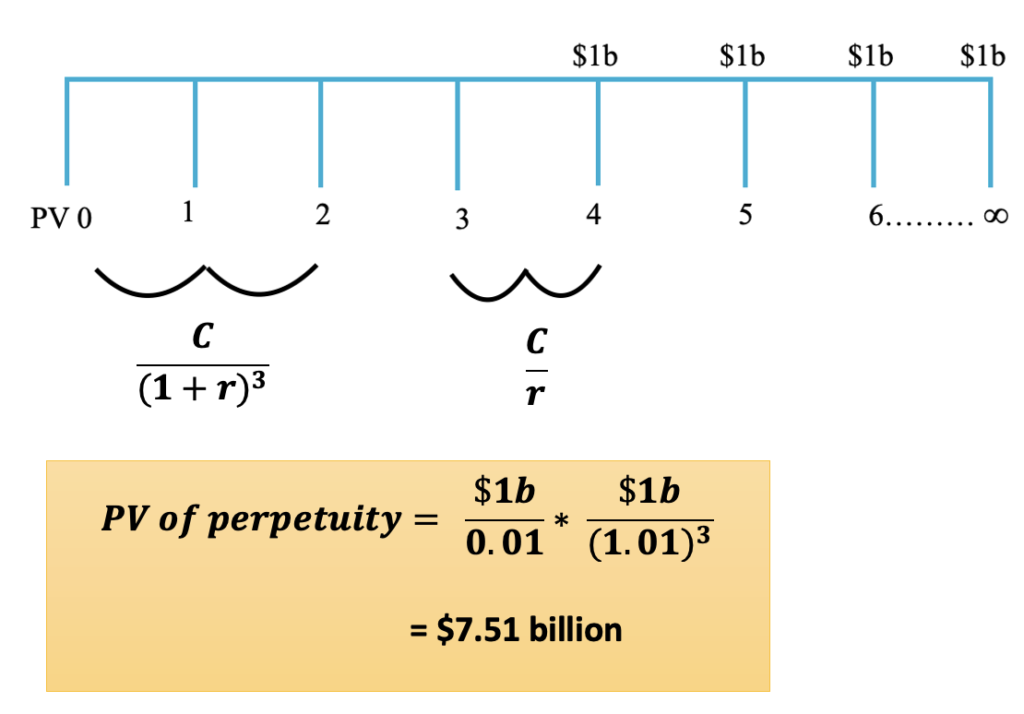

Formula for PV of a perpetuity that does not start to make payments for several years:

Don’t forget to adjust “r” and “t” according to how interest rate is compounded.

Example Question:

Dora will provide $1 billion a year to a charity organisation, with the first payment four years today. If the discount rate is 10%, what is the present value?

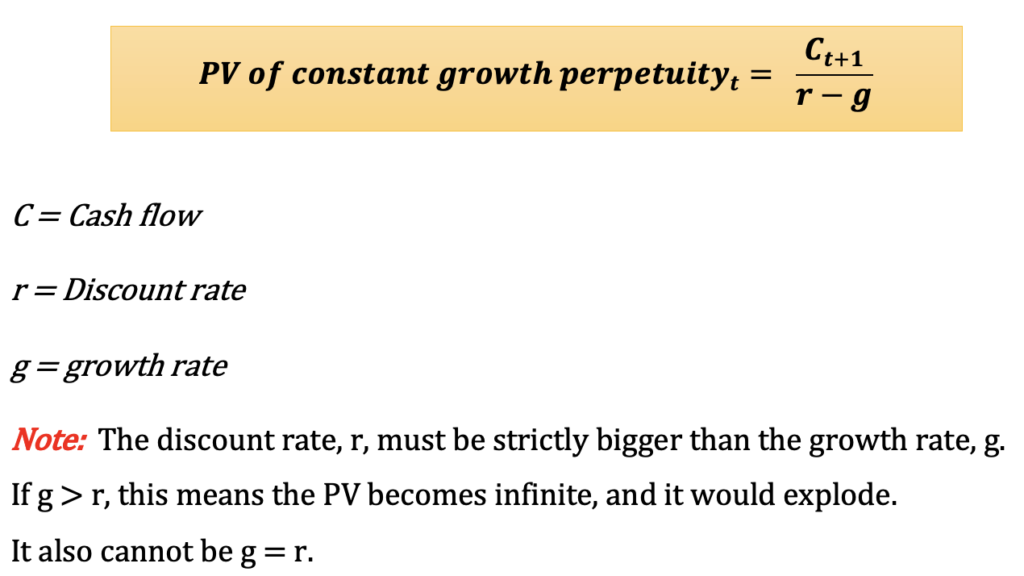

Present Value of a Constant Growth Perpetuity

Constant Growth Perpetuity = A stream of cash flow that grows at a constant rate forever. The payment is not going to be constant (e.g. in year 1 it is $1,000 and year two it grows to $1,500).

Present Value of an Ordinary Annuity

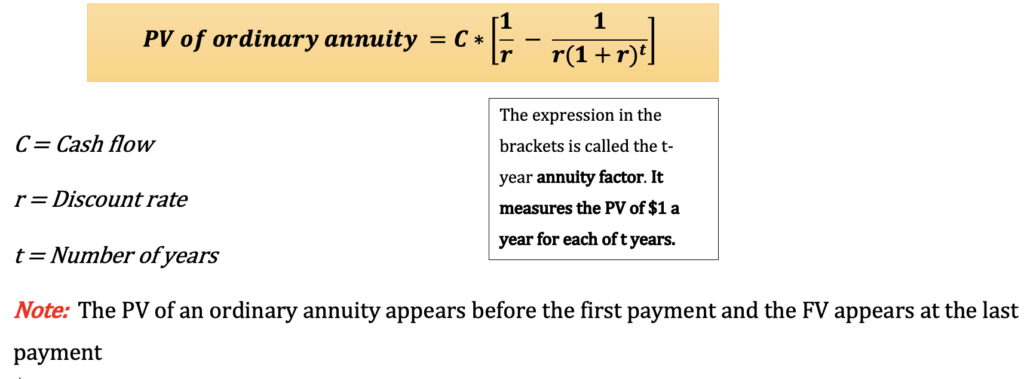

Ordinary annuity = a limited series of constant payments at the end of the period at regular intervals.

Formula:

Don’t forget to adjust “r” and “t” according to how interest rate is compounded.

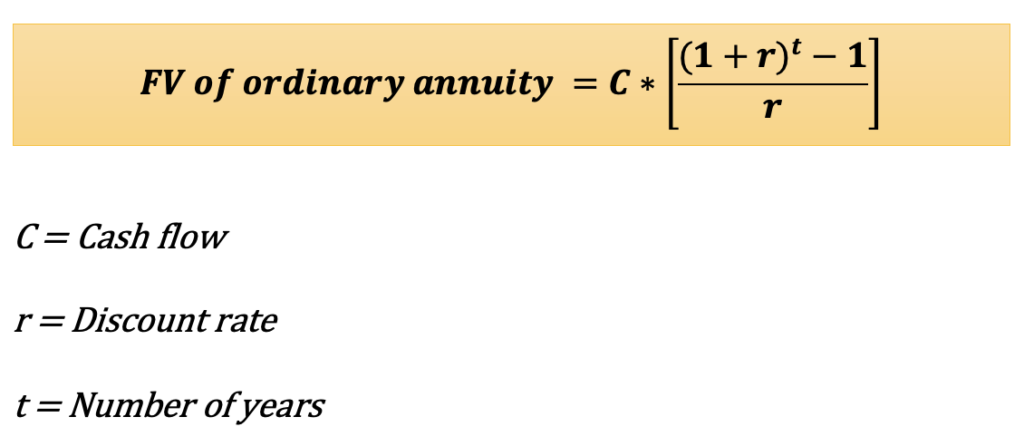

Future Value of an Ordinary Annuity

To find the future value of an ordinary annuity, you can either use the formula below or if you know the present value (PV), then you can multiply the PV by (1+r)^t.

Formula:

Don’t forget to adjust “r” and “t” according to how interest rate is compounded.

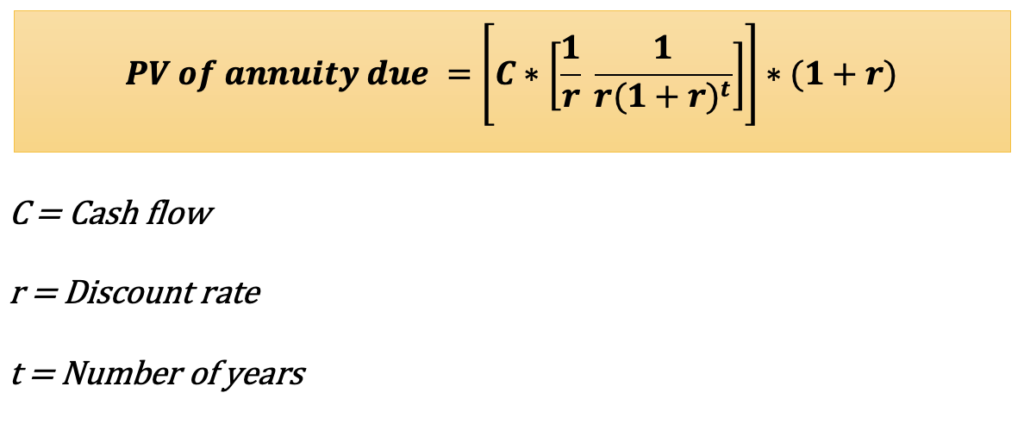

Present Value of an Annuity Due

Annuity Due = A limited series of constant payments starting immediately. Payments appear at the start of the year.

Formula:

Don’t forget to adjust “r” and “t” according to how interest rate is compounded.

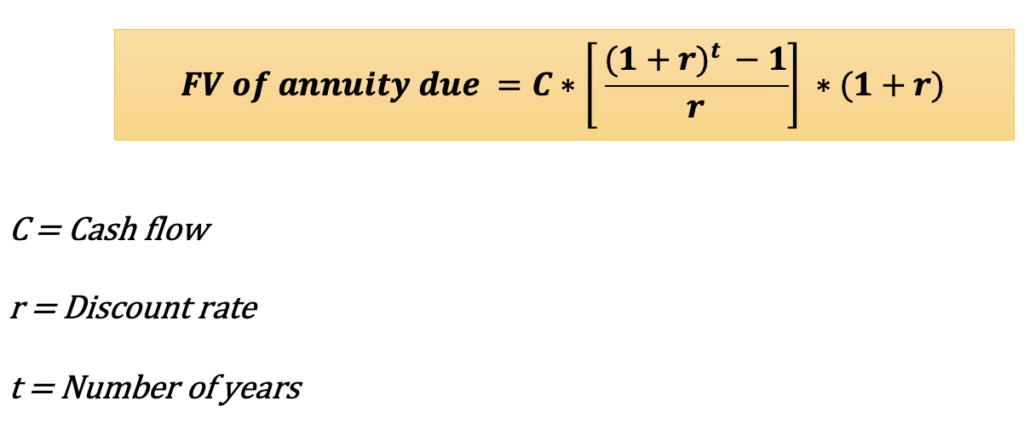

Future Value of an Annuity Due

Formula:

Don’t forget to adjust “r” and “t” according to how interest rate is compounded.

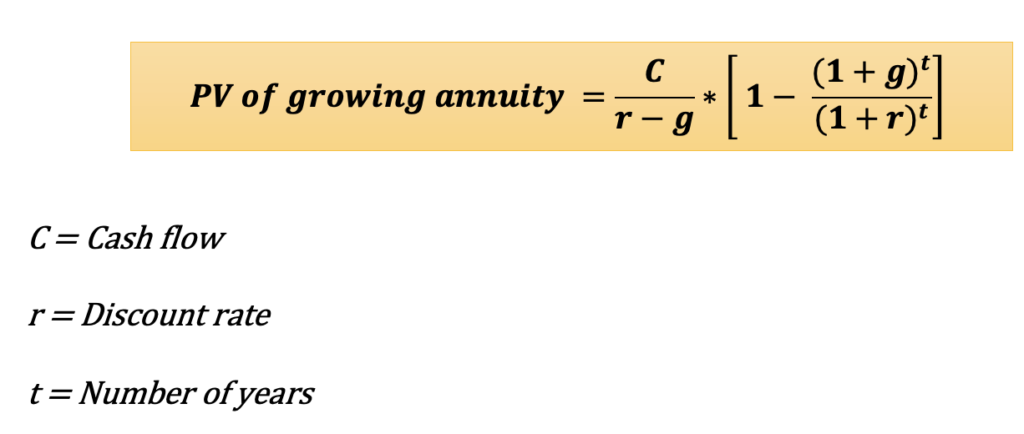

Present Value of a Growing Annuity

Growing annuity = A limited series of constant payments at regular intervals that grow at a constant rate.

Formula:

Don’t forget to adjust “r” and “t” according to how interest rate is compounded.