what are bonds?

A bond is a long-term loan, security or a financial contract that obligates the issuer to make specified payments to the bondholder. It is a key source of capital for the corporate world.

If you need cash to buy assets for your company, you can ask investors to buy your bonds. In return, you promise to pay interest on the amount the bond is purchased for. As an owner of a bond, investors are entitled to a regular interest (or a coupon) payment. At maturity, they get the final interest payment and the face value/par value or the bond’s principal.

Key bond characteristics?

Face Value/ Par Value/ Principal Value – Payment at the maturity of the bond, and the nominal price at which the bond is sold to investors when first issued.

Coupon – The interest payments made to the bondholder. This equals coupon rate times the face value of the bond. It is fixed over the bond’s duration.

Coupon Rate – Annual interest payment, as a percentage of face value. It tells us what cash flow the bond will produce (e.g. at the end of every year, you will receive $150 ). IT IS NOT THE DISCOUNT RATE USED IN PRESENT VALUE CALCULATIONS. BECAUSE IT IS LISTED AS A PERCENT, THIS IS A COMMON MISCONCEPTION.

Yield to Maturity (YTM)- The rate of interest used to discount the bond’s cash flows, and the annual rate of return (IRR) an investor will get if they hold the bond until maturity. If the bond is sold to a new owner after some interest payments have been made, it will then have a lower yield to maturity.

Maturity- The length of the time until the principal is scheduled to be repaid.

Pricing Bonds

A bond’s price equals the present value (PV) of its expected future cashflows. In other words, the price of a bond is its coupon payments and face value discounted at the required rate of return.

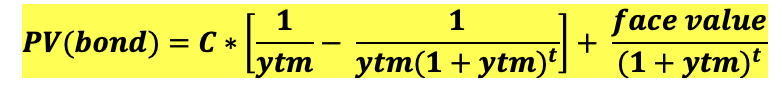

We use the following formula to calculate the PV of a bond:

Example Question

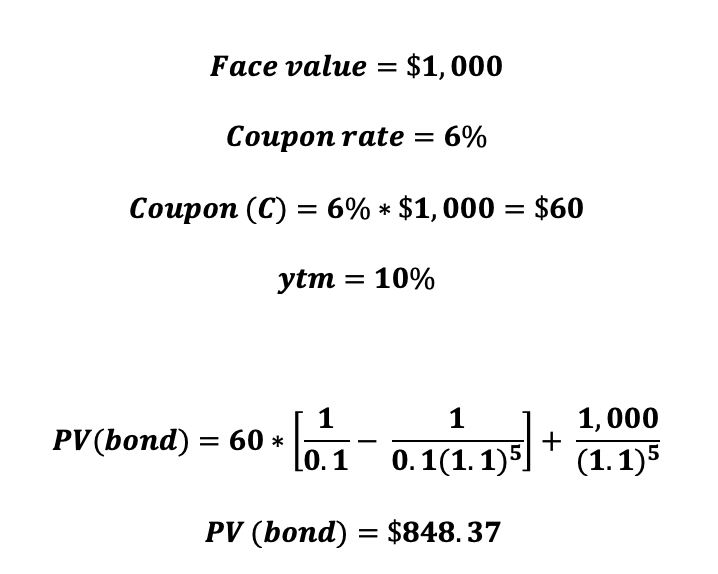

You purchase a 5 year bond with a face value of $1,000. The bond has an annual coupon rate of 6% and the ytm is 10%. What is the value of this bond?

Example Question

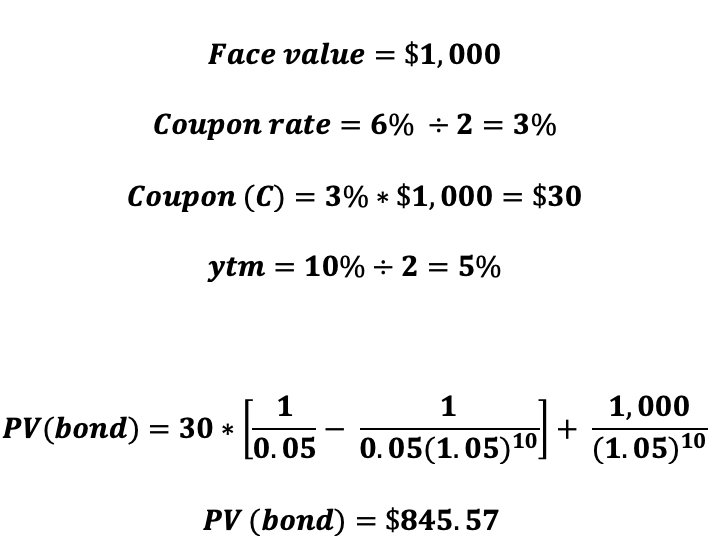

You purchase a 5 year bond with a face value of $1,000. The bond has a coupon rate of 6% compounded semiannually and the ytm is 10%. What is the value of this bond?

Adjusting for Semi-Annual Coupons

For a bond that makes semi-annual coupon payments, the following adjustments must be made to the pricing formula:

- the coupon payment is cut in half

- the yield is cut in half

- the number of period is doubled

How Bond Prices Vary with Interest Rates

As interest rates change, so do bond prices because there is an inverse relationship between interest rates and bonds. Thus, the price of a long-term bond will be more sensitive to interest rate changes than the price of short-term bonds.

- when yields rise, bond prices fall

- when yields fall, bond prices rise

- if ytm > coupon rate, Price/market value < face value. The bond is selling at a discount.

- if ytm= coupon rate, Price/market value = face value. This means the bond sells for exactly its face value. The bond is selling at par.

- if ytm < coupon rate, Price/market value > face value. The bond is selling at a premium.