Lenders and borrowers can choose from a variety of loan structures. The choice of the loan structure will determine the pay rate, which in turn will affect the loan balance at loan maturity.

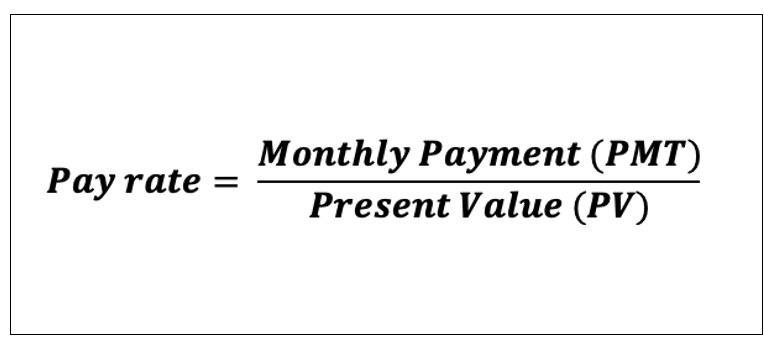

Pay rate = the payment option offered on a loan

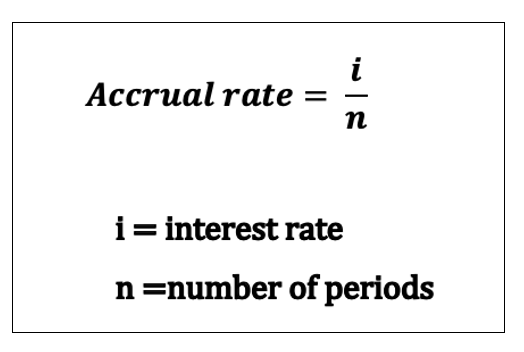

Accrual rate = the accrued (accumulated) interest rate on the loan that is paid until a later date. For example, you might pay interest on a monthly basis, so the accrual rate is the interest rate charged daily on the principal until your monthly payment. For the sake of keeping things simple, just remember that the accrual rate is the periodic interest rate you pay on your loan.

Loan balance = the amount or balance that you owe after taking a loan.

Loan maturity = the time when the loan has to be repaid. If the loan maturity is 30 years, this means that the borrower has to repay the principal amount and the interest by 30 years.

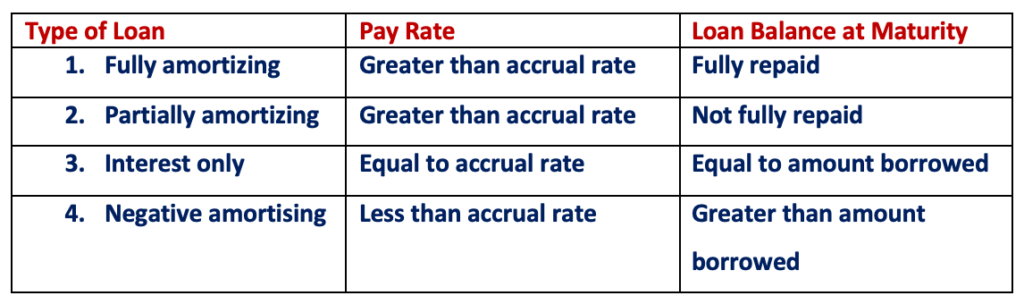

Types of Loans Amortization Patterns

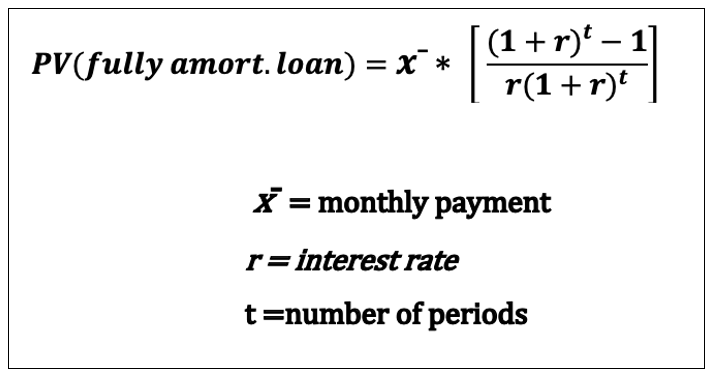

- 1. Fully amortizing loan – a type of loan where the pay rate is greater than the. A fully amortizing loan that ensures that the accrued interest is less than the monthly payments by a sum that is sufficient to cover the accrued interest due each month and to repay the loan in full by the maturity date.

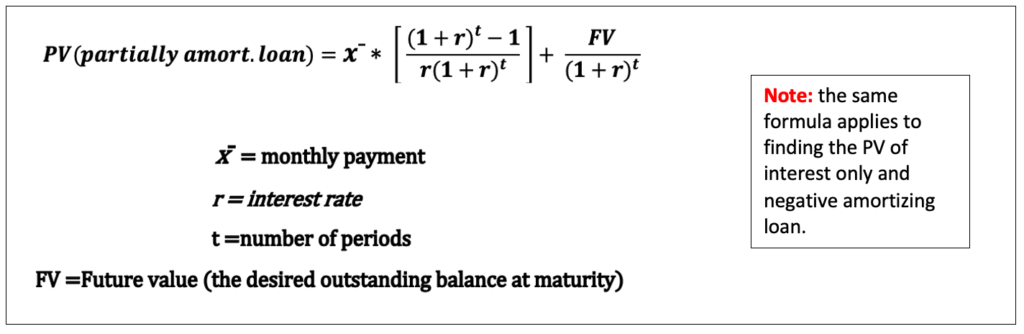

2. Partially amortizing loan – a type of loan where the pay rate is greater than the accrual. A partially amortizing loan will have a pay rate that exceeds the accrued interest to such an extent that it does not fully amortize the loan at maturity. Instead, the loan is partially amortized. The loan balance partially decreases (e.g. to half of the initial amount) from what you started from.

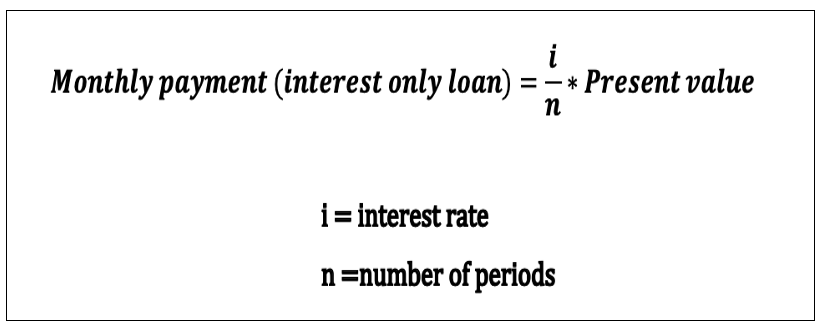

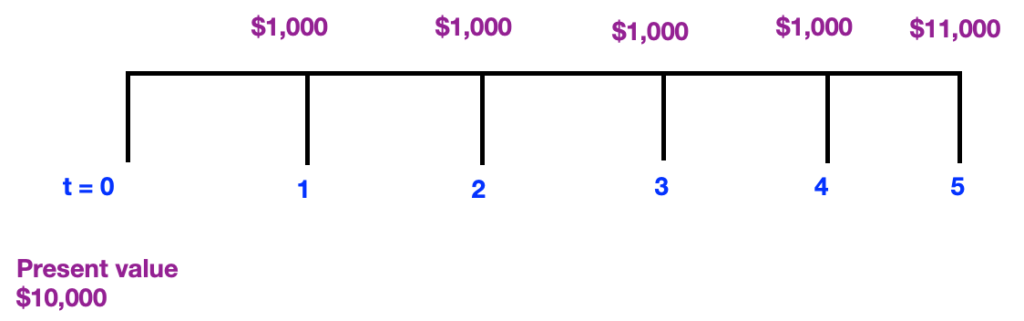

3. Interest only loan – this is a type of loan where the pay rate is equal to the accrual rate. As a result, the loan balance at the end of the month will equal the original loan amount. At maturity, the full loan amount will be repaid.

For example, you borrow $10,000 at 10% interest for 5 years. You will pay $1,000 interest (10% of $10,000) each year up till t=5 and at maturity (t=5), you will also pay the principal.

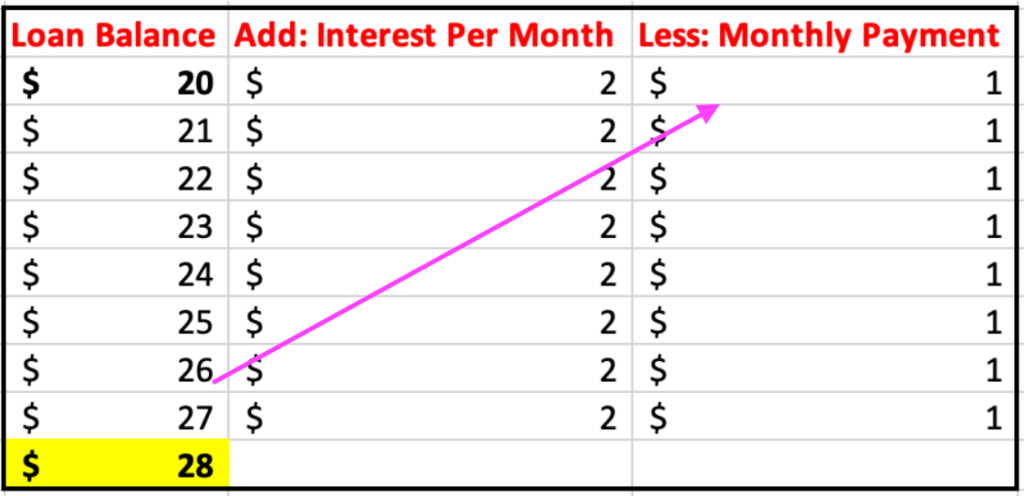

4. Negative amortizing loan – a type of loan where the pay rate is less than the accrual rate. As a result, the loan balance at maturity will be greater than the principle borrowed.

For example, you borrow $20, the accrued interest is $2 and your monthly payment is only $1. The next month you will owe $20+$2-$1=$23 plus $2 interest. Gradually, we will observe an in increase in the amount owed than what was initially borrowed.

Monthly Payment vs Loan Balance

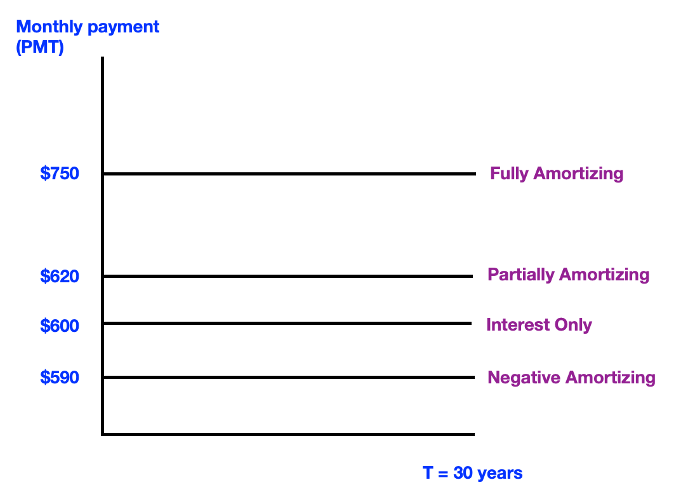

Holding all else constant, monthly payments range from the highest amount with fully amortizing loans to the lowest with negative amortizing loans

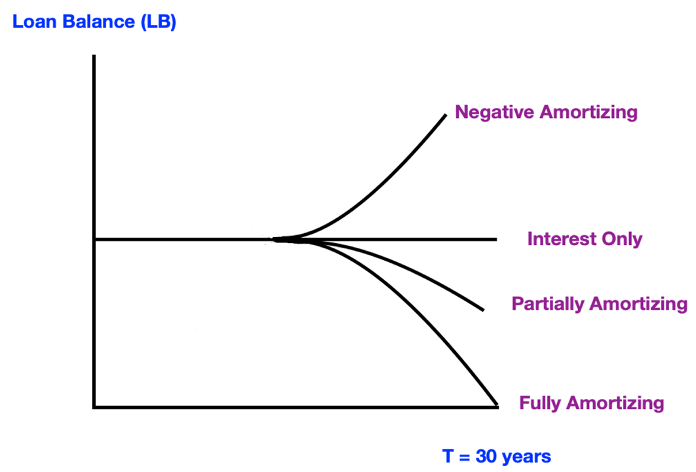

For loan balance, it is the opposite. Loan balance is the highest with lowest payment loans (negative amortizing) and lowest with highest payment loans (fully amortizing)