What is accounting?

Before we start to delve into the world of trial balances, income statements, balance sheets, and cash flow statements, let’s ask ourselves, “what is accounting?”. Well, accounting consists of the following three basic activities:

- Identifying

- Recording

- Communicating

Identifying – as an owner of a business, we would start off by identifying economical events relevant to our business. Suppose we own a grocery store, we will identify economical events such as selling groceries, paying wages, etc. Basically, accounting identifies any events that relate to money or where money is exchanged.

Recording – the economical events that we identified as a business owner, are now recorded in monetary units to provide a history of our store’s financial activities.

Communicating – once we have identified and recorded the economical events relating to our business, we communicate this information in the form of accounting reports (financial statement is the most common one) to interested users.

Who uses accounting data?

As mentioned above, accounting data is communicated to interested users. Interested users are categorized as internal users and external users.

| Internal Users | External Users |

| Human Resources | Taxing Authorities |

| Finance | Labour Unions |

| Management | Customers |

| Marketing | Creditors |

| Investors | |

| Regulatory Agencies |

Internal users and external users use accounting data to answer questions such as:

| Questions | Users |

| Can we afford to give our employees a pay raise? | Human Resources |

| Will the grocery store (in our case) be able to pay its debts? | Creditors |

| Did the grocery store earn a satisfactory income? | Investors |

| Should we eliminate any product lines? | Management |

| Do we have sufficient cash to pay dividends to shareholders? | Finance |

The Basic Accounting Equation

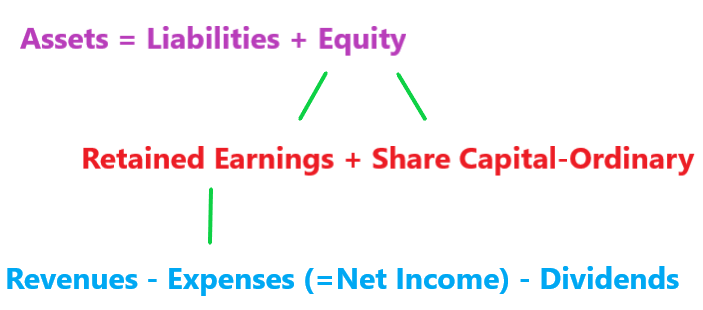

The equation above is called the accounting equation. Assets must always equal liabilities plus equity! If this is not the case, you have made a mistake in your balance sheet (more on this later, but for now, just memorise this equation by heart).

Assets – anything we own or anything that gives us economical benefit.

Examples of assets:

Cash, accounts receivable, inventory, prepaid expenses, investment, equipment, building, goodwill, etc.

Liabilities – are what we owe (to creditors*). These are claims against assets.

Examples of liabilities:

Accounts payable, notes payable, salaries and wages payable, etc.

Creditors* = those to who we owe money.

Equity – any claim of ownership on our grocery store’s total assets (any investment or retention of shares and retained earnings). Either shareholders or creditors can claim ownership of our store’s assets, once we have paid off our creditors’, what is left (residual equity) is claimed by the shareholders. This can be seen mathematically by rearranging the accounting equation to:

Note: Equity consists of:

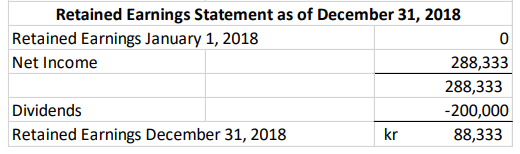

- Retained earnings – this is the amount left over from net income (revenues minus expenses) once dividends are paid out to sharehlders.

So, the basic accounting equation, when expanded, would look like this: