Expectation of future interest rates and future inflation rates

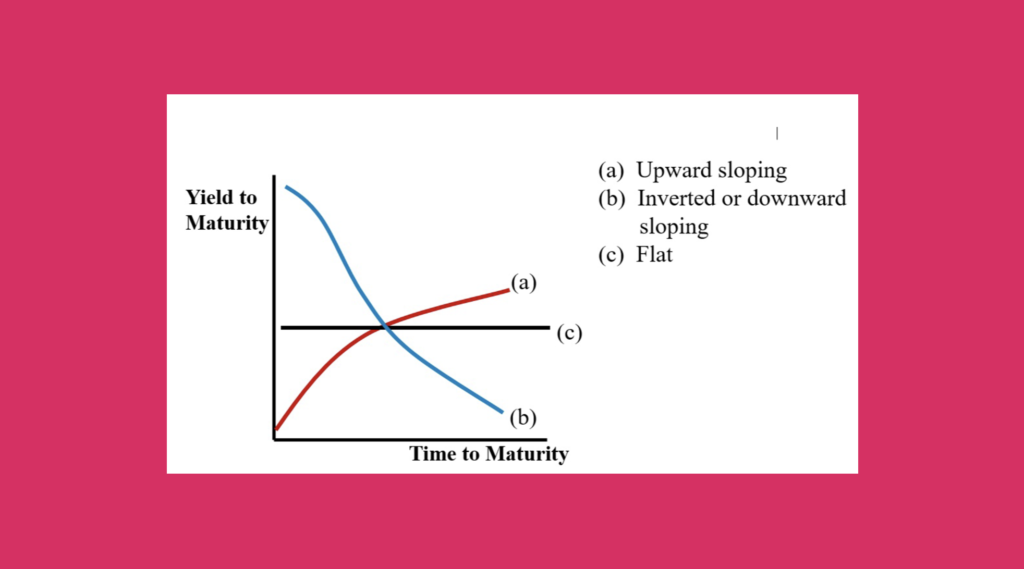

The investor uses the forward rate observed at time zero as a predictor of the expected short-term interest rates in the future and expects that short-term interest rates will be higher in the future. The expectations theory helps us understand the shape of the yield curve because if we observe an upward yield curve, it indicates that the spot rate is increasing. E.g. the 3-year spot rate is greater than the 2-year spot rate. This happens when the expected value of the short-term rate is greater than the current value of the short-term rate. Therefore, when investors expect the future interest rates to rise, we observe an upward sloping yield curve (spot rates are increasing). By the same token, when investors expect that the future interest rates will decline, we will observe a downward sloping yield curve. Similarly, we will observe a high minimum short-term rate when we expect high future inflation and low minimum short- term rates when future inflation is expected to be low.

Market segmentation or preferred habitat theory

Asserts that bond markets are segmented into different maturities, and each market has its own equilibrium interest rate based on the intersection of demand and supply. Based on this theory, we can derive the yield curve is usually upward sloping because generally, investors do not prefer long-term maturities. Instead, there is a higher tendency that investors will invest in short-term bonds. As a result, the supply of funds in short-term bond increases leading to a decrease in interest rates. Thus, we will observe an upward sloping yield curve.

Liquidity preference

As investors bear higher risk when they invest in long- term securities compared to short-term securities, they require a liquidity premium. By referring to this theory, we can interpret the reason that the yield curve is typically upward sloping, even if investors expect the spot rates to be flat. As per this theory, long-term interest rates a derived from both the average of the short-term rates and the liquidity premium, and as the liquidity premium is a factor with a tendency to increase rates upwards, we have a yield curve that is upward sloping.

Interest rate risk premiums

As interest rates change due to unexpected a changes in inflation and economic activity, so do the prices of bonds. The value interest rate varies. As a result, investors require greater interest rate premiums to compensate for the exposure to the higher risk. The interest rate risk premium can be observed as a change in the yield curve. Generally, when there is an expectation of no change in the interest rates, the yield curve is flat. However, because investors require a higher interest rate premium when exposed to greater risk, the yield curve slopes upward. The opposite happens when interest rates are expected to decrease. Even if the interest rate risk premium is required by investors when the expected interest rate declines, the yield curve will be downward sloping.